Contact Us:

info@investingsystems.com

Contact Us:

info@investingsystems.com

Experienced traders are well aware that stop-loss orders are mandatory for every trade. This article will explain the main benefits of using stops to help reinforce the concept.

This seems pretty obvious but it’s really the main benefit of using stops. Any stock you buy has the potential to drop a lot more than you think it could for any number of reasons. If you limit the loss on a trade to say -10%, you get 90% of your money back to move on to a better-timed trade.

With a good stop-loss order in place you have the peace of mind to be doing other things – focus on work and the other important things in your life without the stress that comes with constantly monitoring your investments.

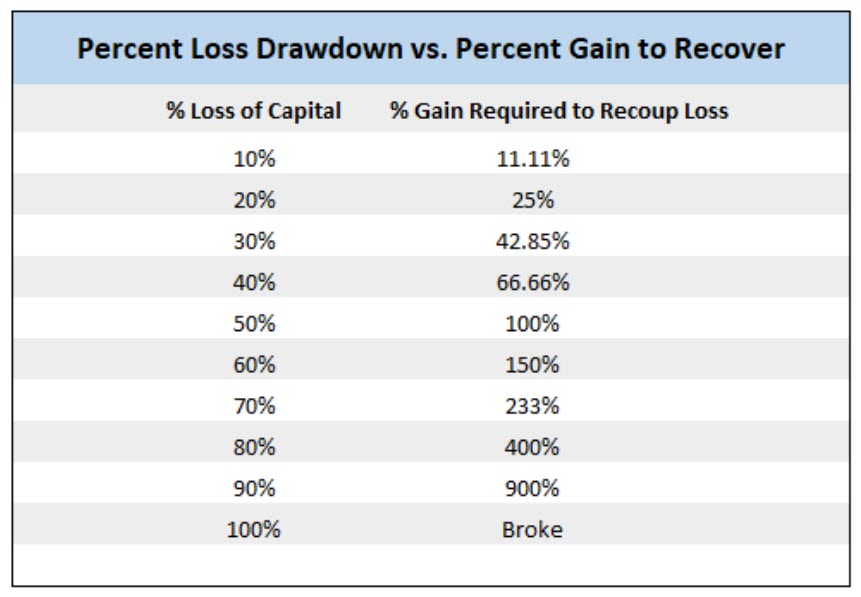

Take a look at the table below that shows the percentage a stock will need to go back up – to recover from a drawdown. Simple math makes it imperative that you never let a trade go too far against you.

Think about all the new all-time highs in the stock market over the last few years. Then take a look some long-term monthly charts of stocks that were considered “Blue Chips” in the past. Go all the way back to 1999 for some real eye-openers. GE, C, INTC, T, PFE, etc.

All it takes is to get in a “high quality” stock at the wrong time and you could be looking at years, a decade (or never) for that investment to get back to your cost basis.

Say you are unfortunate enough to buy a stock right before a big sell-off or peak in the market. Just bad timing. Well, if you limit your loss by setting a stop-loss you can always come back and re-evaluate the stock and choose to get back in – many times at much lower prices. Sometimes a high-flyer can turn into a value stock – at much lower levels. You don’t want to hold through that, trust me. But down the road you might get a much better entry point – when the overall market gives you the opportunity to buy the same stock back at a much lower level.

You did your research and pulled the trigger on a stock only to see it take off and quickly move a lot higher. Sliding your stop-loss up above your entry will guarantee profits on the trade. There’s nothing worse than to be right on a trade and have a big gain – only to watch those profits evaporate over time. We’ve all been there. You jump on a trade and the stock rips higher right off the bat. Over the next few days or weeks the stock starts pulling back and you convince yourself it’s just a normal pullback. Pretty soon you turn around and the stock is back to where you bought it – or worse – it’s now a loss.

This goes back to number 1 and 3. The further you let a stock move against you the harder it is to recover the loss. You’ve heard the old saying about cutting losses quickly and letting winners run. Eventually all investors figure this out (usually the hard way)

You can easily place a stop at your broker to buy the peace of mind knowing you can’t lose big on a trade – and that “insurance policy” doesn’t cost you a thing. If only other forms of insurance were this cheap.

If you’re not using stops then you are essentially winging-it. A well placed initial stop along with a plan for “trailing it up” as price moves in your favor provides a “strategy”.

That’s an old Wall Street saying and it has stood the test of time for a reason. Sticking to a plan of always using stops prevents you from having to “buy and hope” that a stock will recover someday. One of the worst things about letting a stock get away from you is that your money is tied up (waiting for it to recover) for who knows how long. As discussed in #4 some stocks never recover or could end up tying your money up for years when you could have put it to more productive use in a different trade (opportunity cost).

When you place that initial stop you have consciously made a decision that you are only willing to lose a certain amount in the trade. There’s no second guessing about what you are willing to risk.

Let’s face it. The hardest part about trading or investing isn’t really buying a stock – it’s knowing when to sell. Using a properly managed stop-loss lets you know exactly when to sell – and does it for you automatically. It’s a selling strategy that you can have confidence in because you’re only going to get stopped-out if your stock is headed down.

To sum it all up – we recommend that you always place a protective stop-loss order whenever you buy a stock. No matter how strongly you believe in a company or how confident you are that you bought in at the right time – the stock market is a risky place. Your number one goal should always be risk management and minimizing losses on every trade. This is why it’s imperative that you use stops.

Looking for more than just charts? These institutional-grade trading platforms offer a wide range of features and are among the most popular in the industry. Take your trading to the next level with professional tools.

Powerful tools such as real-time market scanning, AI-driven trade signals, customizable alerts, advanced charting capabilities, and time-saving data visualization, Trade Ideas offers you the confidence to make smarter trading decisions.

Everything you need to make better trading decisions, all in one place.

TrendSpider’s patented tools make technical, fundamental and alternative analysis seamless and efficient. Level up with real-time data and powerful automation. Detect actionable patterns and trends instantly on any chart

Trade futures with the industry leader. NinjaTrader is a unique futures trading provider, centralizing all the tools and services needed for both new and experienced traders to enter the global futures markets.