Contact Us:

info@investingsystems.com

Contact Us:

info@investingsystems.com

I recently stumbled across an amazing paragraph of text that centered around using stop losses. It was clearly from some age-old book, I could tell by the format and typography.

Everyone in this business knows that there’s plenty of ancient wisdom that’s been passed down through the ages – that remains just as relevant today as it was when it was written.

Initially I thought the excerpt I found was from Jesse Livermore’s Reminiscences Of A Stock Operator

(That’s a classic and a great read if you haven’t already done so)

But after searching around and not finding it there I had to do more digging. Eventually I discovered that the excerpt was actually from a book written by the late W.D. Gann in 1949 titled “Forty-Five Years In Wall Street“.

W.D. Gann was and still is a famous name in the investing community, mostly due to his development of esoteric technical indicators, such as Gann Angles and the Circle of 360. Your charting software probably has several Gann indicators built-in.

Gann’s market forecasting methods are based on geometry, astronomy and astrology, and ancient mathematics. Opinions are sharply divided on the value and relevance of his work, but just about everyone in this business has heard of Gann.

Reading through this old book, I ran across several brilliant excerpts that are still extremely relevant today and I’m going to share all three tidbits of wisdom here.

What really struck me as the most interesting…

Was that three little sections – from a book published in 1949 – are almost completely consistent with the the style of trading we’ve been advocating all these years. Mostly related to stocks, but it’s easy to see how some of the material relates to trading other instruments such as Futures

In the world of trading and investing there are plenty of universal constant, timeless concepts. But it’s fascinating to read something written so long ago that strikes a chord with the style of trading many investors use to this day.

In fact, reading these 3 little excerpts from his book just reinforced the fact that we are definitely on the right track with our strategies.

I just thought it was such a coincidence these excerpts are essentially “core principles” of Investing Systems – even though I had no idea this book existed until recently.

You’ve probably seen something similar on our site or heard me mention in on the show. If you’ve read through our material you know that stop-losses are at the core foundation of any viable tradingy strategy and reading that age-old excerpt just reinforces it.

Like I said, there are scores of timeless concepts when it comes to trading stocks. I know for a fact Mr. Gann didn’t come up with the idea of using stops, but he certainly drives home the point very eloquently.

Here’s another good line from the book:

Good advice from 1949 that is still true today.

This next excerpt really took me by surprise because it describes almost perfectly another one of the main strategies we’ve built into every trading system we’ve ever released.

Again, I had no idea this paragraph existed until recently, but it basically explains the strategy we’ve been using for years – getting your initial stop to breakeven.

Even though our Power Emini Alert software is designed for intraday Futures trading, we have this exact formula built into it. Basically the software automatically trails the stop-loss as a trade moves in our favor.

We call them “Dynamic Trailing stops” because the back-end that drives everything is programmed in such a way that it uses a complex set of logic to determine exactly when and where to move the stop, based on Price and Time and current ATR’s in the market.

So basically what Mr. Gann suggested in his infinite wisdom was to trail up your stop to protect profits. Not really an earth shattering concept, but again – it reinforces exactly what we programmed into out intraday trading logic. Every day, our Trailing Stops get updated so they are always maintained at the appropriate level. Like I said, some concepts are universal and timeless.

The Third Excerpt From the Book Delves into Position Sizing.

Here again, Gann’s ideas are consistent with just about any modern investing or trading advice you’d hear anywhere – diversification, proper position sizing and risk-management.

The first part deals with diversification – which every investor knows is a critical component of success. Harry Markowitz (Nobel prize winning economist) called diversification “the only free lunch in finance.” In other words, you don’t want to put all your eggs in one basket and you never bet the farm on one trade.

The second part of the excerpt is about starting off small and managing risk. Imagine if Mr. Gann had today’s technology at his fingertips!

But the idea is as valid today as it was back in his day. It almost goes without saying that proper diversification is a must – in other words if you are holding 6 stocks in your trading portfolio you don’t want them all to be in the same sector.

Diversification is why ETF’s and index funds are so popular these days.

Finally, the last sentence in that excerpt is really a good one.

I would have said “when it comes” because we all know that there will be stop-outs and losses in trading, it’s just the nature of the business. But starting off small, properly sizing positions, using stops – and having a strategy – is what eliminates the stress and anxiety of trading.

Basically he addressed investor psychology in that one sentence.

So when you put these three short excerpts from W.D. Gann’s book together, they are amazingly consistent with the strategy we’ve been advocating over all these years. When I stumbled across them it really reinforced the idea that our model is solid. While they may seem patently obvious to most experienced traders, almost everything Gann said still holds true today and is consistent with the strategies just about any successful trader uses (or should use).

1) always use a stop loss order (read my blog post on why)

2) get your stop to breakeven as quickly as possible

3) trail the stop up to protect profits

4) spread your trading capital among multiple investments (diversify)

5) size your positions properly so you aren’t risking a lot on any one trade (or investment)

6) keep your position sizes small – so that any one loss won’t affect you psychologically or financially

7) another good trading opportunity always comes along

I think Mr. Gann did a fantastic job of stating these trading rules in a way that really drives home the points. As experienced traders we could almost say that they are common sense – they are solid concepts that have stood the test of time.

But trading is a constant learning experience and reading something that was written so long ago that still holds true really helps reinforce and drive home the concepts. And they are especially helpful for newer investors.

I would go as far as to say that a brand-new novice investor that is just getting started would be wise to read those over several times and follow those rules.

Here’s another line from the book – you may have heard this one as well.

I don’t know if he was the first to say that, but he was certainly not the last.

Having a strategy is what it’s all about. That’s the key to success in the market.

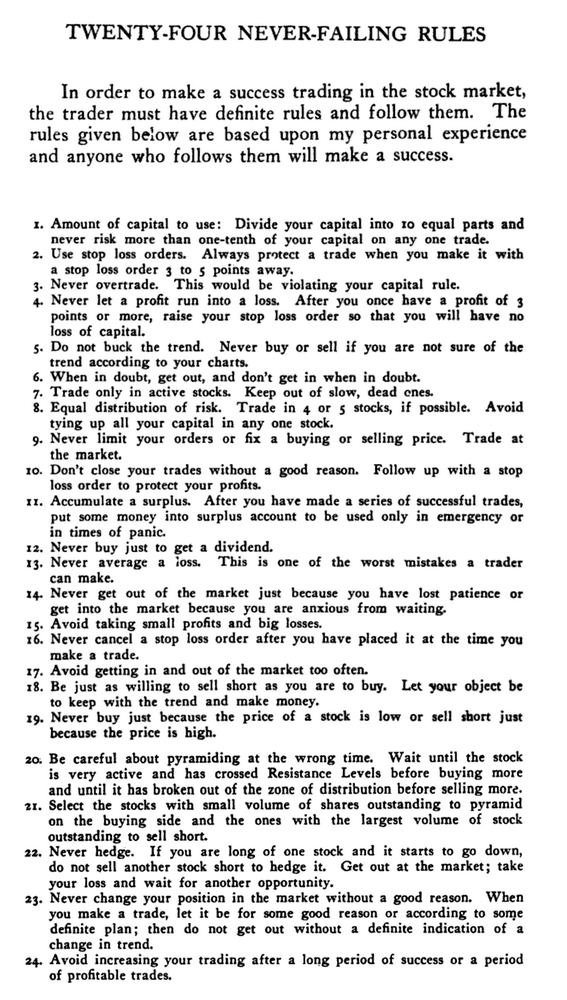

Lastly, in the book Mr. Gann published what he called “Twenty-Four Never-failing Rules”

Here they are:

So as you see, while Mr. Gann was probably most famous for inventing all those esoteric indicators, he had a deep understanding of the core principles that are crucial to success – and they are still used to this day.